We located the right suburb for a Mobile Audiences deep dive: the suburb of Naperville, Illinois, just west of Chicago. The town features a sprawling outdoor history museum that depicts life in Naperville’s early days, but with a population of almost 150,000, it’s a thoroughly modern city. In Naperville, the median age is 35 and a median family income is $127,5541. The town has a vibrant Main Street shopping area as well as a commercial district with major big-box retailers. These are stats we love to look into, so we decided to study Naperville for two weeks to discover what kind of audiences can be found there.

Mobile Audiences Data in Naperville

The video above shows activity on mobile devices during a two-week period in Q4 of 2018 in Naperville. Complementics engineers geofenced the shopping district to observe mobile device activity throughout the time period. What did we see?

- Activity on 122,271 unique devices and more than 8.8 million events

- Average of 23,000 devices seen on average 30 times per day

- Visits to more than 15,057 Points of Interest (POIs) in Naperville – an average of 237,331 visits per day

- Retail traffic was booming – Target had 15,314 events, WalMart saw 12,401 and Nordstrom clocked in at 7,556

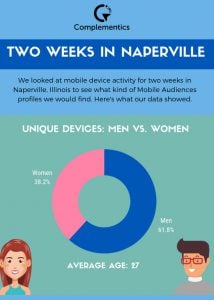

- The average age was 27 years old

- There were more men than women active – 61.74% men vs 38.2% women

Rich Data for Deep Study

With access to more than a billion devices globally, we can look at almost any POI on the globe to deliver specifics such as mobile device type, age, gender, and more. On average, we can track more than 53 billion events per day from more than 74,979,500 unique devices globally.

We deliver data to our clients at agencies, publishing firms,brands, hedge funds, and more so they can get the rich insights.

Our clients use this data to:

- Refine audiences for ad targeting

- Deliver better search results to site visitors

- Make smarter decisions about future investments

- Drive visitors to the right content

- Understand brand activity and affinity

- Augment brand loyalty data

- Push the right content to the right person at the right time

Data at Scale

Looking at two weeks in one midwestern suburb delivers a lot of data. Imagine what you could do with this kind of data at scale. Peer into activity at points of interest across a city – or across the globe, dig into activity to see which demographic is visiting your retail locations, or find out if traffic is increasing because of in-market ad campaigns you’ve placed.

Find out more about our data, location services, audiences platforms and more. Visit our location data page, or get in touch with us for more information.

1 City of Naperville statistics, https://www.naperville.il.us/about-naperville/demographics-and-key-facts/

** Please note: Complementics data is representative of data accrued by Complementics and its data partners.

Gaming and Hotel Loyalty: One client recently looked at all the Las Vegas visitors who were members of their loyalty program to answer location-based questions such as, How far did visitors travel to get to Las Vegas? Where did they go while they were here? Which of my competitors’ locations did they visit? How long was their stay?

Gaming and Hotel Loyalty: One client recently looked at all the Las Vegas visitors who were members of their loyalty program to answer location-based questions such as, How far did visitors travel to get to Las Vegas? Where did they go while they were here? Which of my competitors’ locations did they visit? How long was their stay?